Hapag-Lloyd unveils new fuel surcharge mechanism for 2019

Hapag-Lloyd on Monday unveiled a new fuel surcharge mechanism designed to help cover the costs of transitioning to low-sulfur fuel, which will be "gradually implemented" as of Jan. 1, 2019.

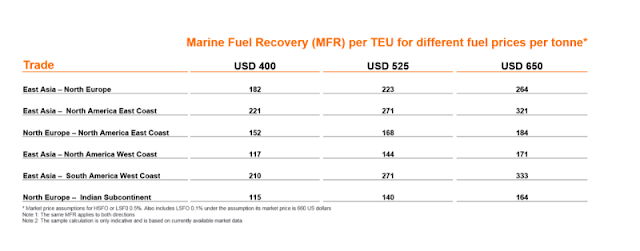

The "Marine Fuel Recovery" mechanism is a cost formula, taking into account vessel consumption per day, fuel type used and the price of fuel used in each trip while accounting for market fluctuations. The carrier estimates the transition to low-sulfur fuel will cost it $1 billion in additional costs in the first year.

The cost estimates are in line with those provided by CMA CGM, Maersk and MSC, as all carriers prepare to comply with new International Maritime Organization regulations that will take effect in January 2020.

Experts say the cost of transitioning to low-sulfur fuel will be between $24 billion to $60 billion for the entire industry. The largest carriers cited above, meanwhile, are citing between $1 billion and $2 billion hits due to the new rules.

"Given that the industry has only had a cumulative profit of some 8.6 billion USD in the total period from 2012-2017, it is blindingly obvious that the vast majority of this added bill can only be paid by the shippers," Lars Jensen, CEO and partner at Sea Intelligence Consulting, wrote on LinkedIn. "The only interesting question is:

How?"

Hapag-Lloyd's solution appears to be to create a simple adjustment formula, pegged in some way to market fuel prices, trade lanes and the total mass carried by vessels.

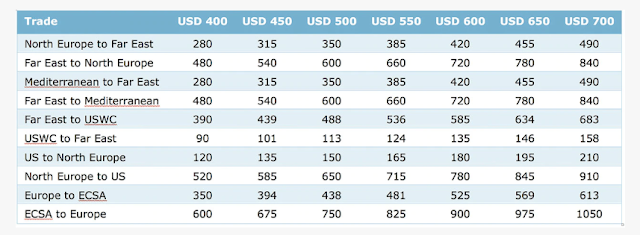

The solution is similar to Maersk Line's, which in September said its "new bunker adjustment factor" would follow a more vague formula: Fuel price x Trade factor = BAF. The trade factor is calculated by fuel consumption per container moved on the trade, combined with an "imbalance factor" to adjust for headhaul versus backhaul.

CMA CGM, by contrast, opted for a trade-by-trade fuel surcharge system, "at an average of 160 USD / TEU," without a clear explanation of how the additional surcharge was evaluated.

Given the vast costs to the shipping industry, shippers should expect other carriers to follow suit. Shippers' associations, meanwhile, have made it clear they do not approve of the practice.

"Carriers impose it unilaterally without any negotiation with shippers and ignore a market approach to the global problem," the European Shippers' Council said in September, after Maersk's BAF announcement. "This does not set an ideal cooperation scenario."

"It would have been better if Maersk had discussed its plans with individual customers in the course of confidential contract reviews," James Hookham, secretary general of the Global Shippers Forum (GSF), said in a September statement.

"GSF would encourage Maersk to consult with customers and reconsider their strategy," Hookham said. "These new charges may be all about low-sulphur fuel, but they still stink to us!"