The prolonged shortage of shipping containers in China is showing signs of easing, according to Container xChange.

Gary Howard | Mar 22, 2021

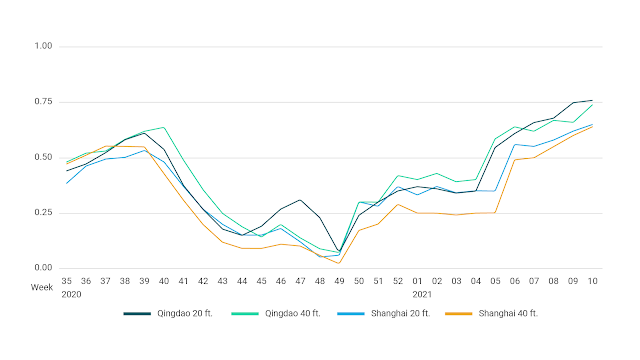

The company’s Container Availability Index (CAx) across China's main ports rose by 56% compared to before Chinese New Year. For Shanghai, CAx rose by 64% and 112%, respectively for 20-foot and 40-foot containers from before Chinese New Year to after the holiday.

Dr Johannes Schlingmeier, CEO & Founder of the container leasing and trading platform Container xChange, said that although the seasonal drop in China’s output during New Year celebrations was softer than usual, it still allowed for an improvement in the container supply/demand balance.

Container prices remain abnomrally high, but have reflected improving supply, falling from a peak of $5593 in January to $3750 in February, according to Container xChange.

A CAx reading below 0.5 means more containers leaving a port than entering it, while a reading above 0.5 means more containers entering than leaving.

Between the Chinese ports of Shanghai, Qingdao, Dalian, and Ningbo, Dalian showed the highest availability of containers; its CAx reading after Chinese New Year reached 0.79 for 20-foot boxes and 0.80 for 40-foot. Dalian was the only port of the four to enter 2021 with CAx above 0.5 for both 20- and 40-foot containers, availability at Dalian has improved this year, but less than in the other ports.

“One week of index values greater than 0.5 does not mean so much but exceeding the 0.5 marks for several weeks in a row like Shanghai and other main ports in China have done means that finally more containers are entering ports regularly, giving them the chance allow the container supply/demand imbalance to reduce,” said Schlingmeier.

“With so many supply chain disruptions still evident, we expect container availability in China and elsewhere to remain volatile. But thus far in 2021 there are positive signs that availability at key export hubs is improving,” said Schlingmeier.